NIBC’s Commercial Real Estate business show solid results in dry market

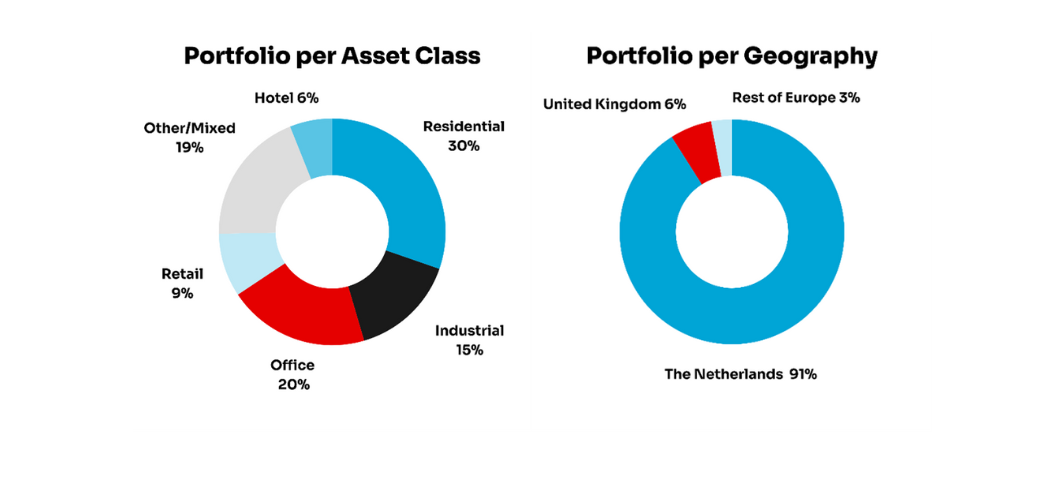

NIBC Commercial Real Estate showed stable results while operating in a slow market in 2023. Despite the dry market with high inflation and interest rates, our portfolio size and quality was stable, EUR 1,843 EUR compared to EUR 1,857 million in 2022. This includes the portfolio of OIMIO as our real estate label continued as NIBC to join NIBC's existing and experienced Commercial Real Estate team. In doing so, NIBC created a strong and clear market position for commercial real estate financing from EUR 5 million to around EUR 50 million.

NIBC actively focused on the expansion of its finance offering within the European Real Estate across prominent cities in Western Europe through club deals to support the development, construction, and investment of Living projects in the UK and Spain.

In 2023, NIBC has continued to execute its focused strategy as an entrepreneurial asset-based financier. Backed by the launch of the new brand positioning at the beginning of the year, NIBC has further strengthened its proposition, resulting strong results in all core segments.

Jan Willem van Roggen, Head of NIBC Commercial Real Estate:

“In the first half year of 2023 our focus has been on refinancing existing loans and supporting clients in managing their interest rate risks. However, we saw an increase in activity for the second half of the year that continues into 2024. Our commitment still lies in enabling the ambitions of commercial real estate developers, constructors, and investors through our tailor-made financing solutions.”

We see positive developments on ESG and we remain committed to greater sustainability and emission reduction. With the successful launch of our ESG Client Portal, NIBC Commercial Real Estate remains dedicated to helping clients with their sustainability transition.

We refer to our Annual Report 2023 NIBC Holding N.V. published on our website for full details.