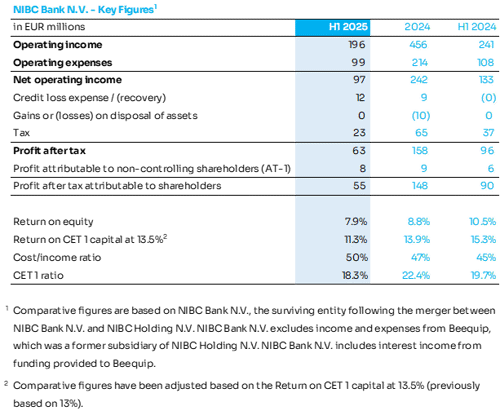

NIBC reports a net profit of EUR 55 million for the first half of 2025

- Solid performance with net profit of EUR 55 million for H1 2025, interim dividend payout ratio of 50% and a return on target CET1 of 11.3%.

- Continued growth across core business lines: +1% in Mortgages, +2% in Retail Savings, +2% Commercial Real Estate and +3% Digital Infrastructure.

- Strong capital position following the introduction of Basel IV regulation at a CET1 ratio of 18.3%.

- Comprehensive strategy review completed to drive enhanced commercial success in targeted markets and continued optimisation of organisation, processes and cost base.

- Strengthened brand awareness through initiatives including sponsorship of the NIBC Tour of Holland cycling event.

Statement of the CEO, Nick Jue:

“In the first half of 2025, NIBC delivered solid results, reporting a net profit of EUR 55 million, with a return on target CET1 capital of 11.3% and a strong CET1 ratio of 18.3% following the full implementation of Basel IV. H1 2025 net profit is down EUR 35 million compared to H1 2024, mostly driven by Beequip, yesqar and our Shipping activities no longer contributing.

We achieved continued solid growth across core business activities in the first half of 2025. Our customer base expanded in both Retail Savings and Mortgages, with mortgage exposure increasing by 1%, despite a highly competitive mortgage market. Retail Savings grew by 2%, driven primarily by successful campaigns in the German and Belgian markets. In our Corporate Banking portfolios, we saw an increase in exposures, with Commercial Real Estate and Digital Infrastructure growing by 2% and 3%, respectively, despite a market characterised by slower financing activities.

Additionally, we continued to successfully optimise our portfolio by reducing non-core exposures.

We streamlined our business proposition and de-risked our balance sheet, notably through the sale of our Shipping franchise in the first half of 2024 and the successful transfer of ownership for both platform activities, Beequip and yesqar, at the end of the year.

Following this we conducted a comprehensive strategy review in the first half of the year to sharpen our focus on core business lines, including Dutch Mortgages, Retail Savings and Commercial Real Estate and Digital Infrastructure financing. To enhance our retail proposition, we are exploring the introduction of retail investment products to broaden our offering to clients. As part of this review we also continue to further optimise our organization, processes and cost base. To date this has included implementing a new top structure, further delayering of the organisation and setting up an operating model with business lines fully dedicated and focused on Mortgages, Retail Savings and Corporate Banking.

To support our growth ambitions, we are focused on increasing brand awareness in the Netherlands and are proud to sponsor the 'NIBC Tour of Holland' cycling event in October 2025.

Looking ahead, we anticipate stable economic conditions with moderate growth for the remainder of 2025. The Dutch economy has shown resilience, maintaining moderate growth amid ongoing economic and geopolitical uncertainties. The housing market remains strong, and we expect house prices to continue to rise.

This year, NIBC celebrates its 80th anniversary, a milestone that not only fills us with pride but also serves as a reminder to commemorate our freedom. While both the world and our bank have evolved over the years, the fundamentals of our original mission to help rebuild the Netherlands after WWII, continues to inspire our purpose today. We remain dedicated to supporting our customers in building homes, growing their businesses, and accumulating wealth.

On behalf of the Managing Board, I would like to thank all our colleagues for their commitment and dedication to their work and our customers. Together, we have set a strong foundation for further growth in the first half of 2025, and I look forward to continuing to serve our customers and helping them in achieving their ambitions.”

We refer to our Condensed Interim Report 2025 NIBC Bank N.V. published here for full details.

For our full press release, please refer to the Download below.