NIBC: Expertise in Shipping, Short Lines, and Genuine Partnership

By Misha Hofland

For more than 50 years, NIBC has been a trusted financial partner for shipowners and investors in the maritime sector. The bank provides financing services to clients in key maritime cities such as Athens, New York, and Singapore. It primarily operates in Northwestern Europe with a solid foundation in the Netherlands. "We have a long history and strong roots there," says Michael de Visser, Director of Shipping at NIBC.

Michael de Visser: "The Dutch market is significant for us. As a true financing bank, we offer tailor-made financing solutions for shipping ranging from €10 million to approximately €50 million per transaction." He notes the emerging trend where parties with a few ships often struggle to secure financing for new projects. "They may not find opportunities with major banks. Traditional financiers seem to focus on financing much larger enterprises in the shipping industry. For such cases, NIBC can serve as an excellent alternative. While we may sometimes be less visible due to our focus on financing and lack of nationwide branches, our extensive experience in maritime financing makes us a valuable partner. NIBC provides asset financing not only in shipping but also in sectors such as mortgages, real estate, and digital infrastructure."

Growth Strategy and Innovation

The director of shipping at NIBC observes that many shipping companies owning a few vessels are embarking on consolidation and professionalization efforts. "Commercial management is becoming increasingly professionalized. Strategic partnerships, including those with investors, are common. We believe we can play a crucial role as a partner to these shipping companies in their growth strategy. There are excellent opportunities for collaboration between shipowners, private investors, and us as a financing bank."

"Shipping companies with growth ambitions often lack sufficient liquidity in this capital-intensive sector, despite ample capital in the market seeking good returns. However, finding the right partners is crucial. We also understand that there is a need to finance older vessels in the market, while other financiers tend to focus more on new builts. Some vessels can be retrofitted to become more environmentally friendly, but this also requires investment."

"I believe there is much more to be gained in greening the maritime sector than just ordering new vessels. Additionally, everyone in the shipping industry knows that an oversupply of new ships can lead to correction, causing many financiers and investors to withdraw. Therefore, balanced innovation is essential. This includes a focus on greening the existing fleet. NIBC specializes not only in financing new purchases but also in refinancing existing ships and other maritime assets and implementing modernizations."

Partnership

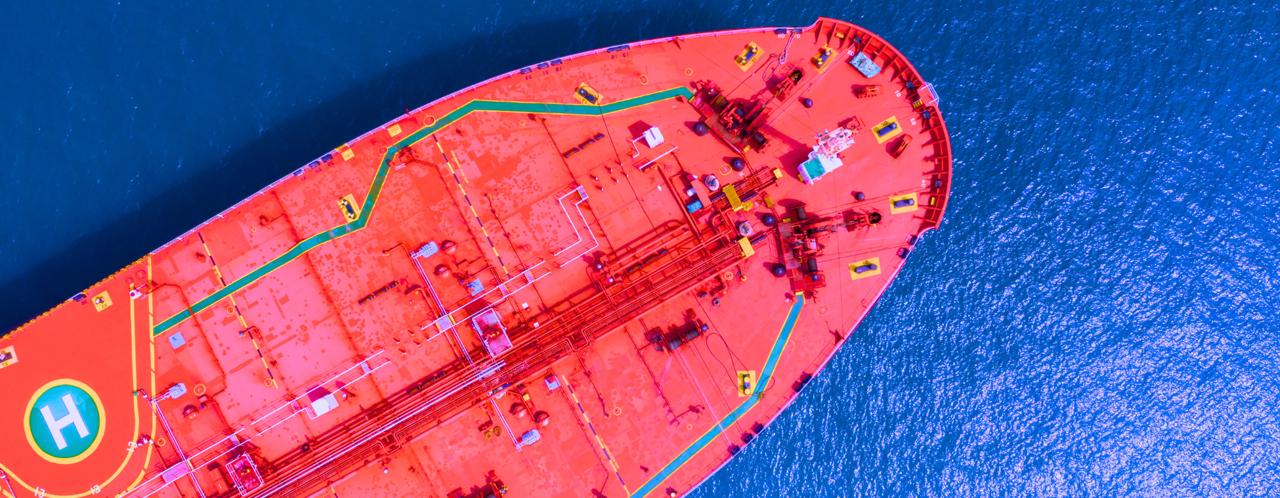

At NIBC, the emphasis is on more common vessel types such as chemical tankers, gas tankers, and dry cargo ships, primarily in deep-sea shipping. However, the bank is cautiously exploring opportunities in inland shipping. De Visser explains, "Inland shipping plays a crucial role in the logistics process, and we're seeing more parties turning to NIBC for their financing needs related to growth or greening because they are either too large or too small for other financiers. We offer clients a genuine partnership, brainstorm with them, and provide quick and honest feedback on what we can or cannot do."

Short Lines

Why do clients choose NIBC as their financier? Director Michael de Visser has the answer. "Our distinctiveness lies primarily in the fact that we are a flat organization. We are a professional entity with 600 employees. Due to our relatively small size, the lines of communication are short, and we can act swiftly. I believe that's the strength of NIBC; we are not a large corporate bank but a small entrepreneurial bank. The risk department is just down the hall from us. We are a bank that tries to find solutions together with the client and can do so very quickly. While a rejection may sometimes come swiftly, we often still try to find a solution together."

"This speed can also be beneficial when clients urgently need financing solutions. The costs may be slightly higher, but we still offer a quick bespoke solution. At NIBC, you certainly won't get lost in a large, layered organization, and you'll quickly connect with decision-makers. Another advantage of our relatively small organization and experience in shipping is that we know all our clients well and are well-informed about market dynamics. We have a team with many senior colleagues who have been in the industry for a long time. As a result, we can genuinely collaborate with shipowners. Clients quickly realize that at NIBC, they're truly sitting across from a partner who can spar with them."

Read the article on Schuttevaer.nl.